May 06, 2025

To learn more about how AdInsure works in practice, watch the video or read the full transcript.

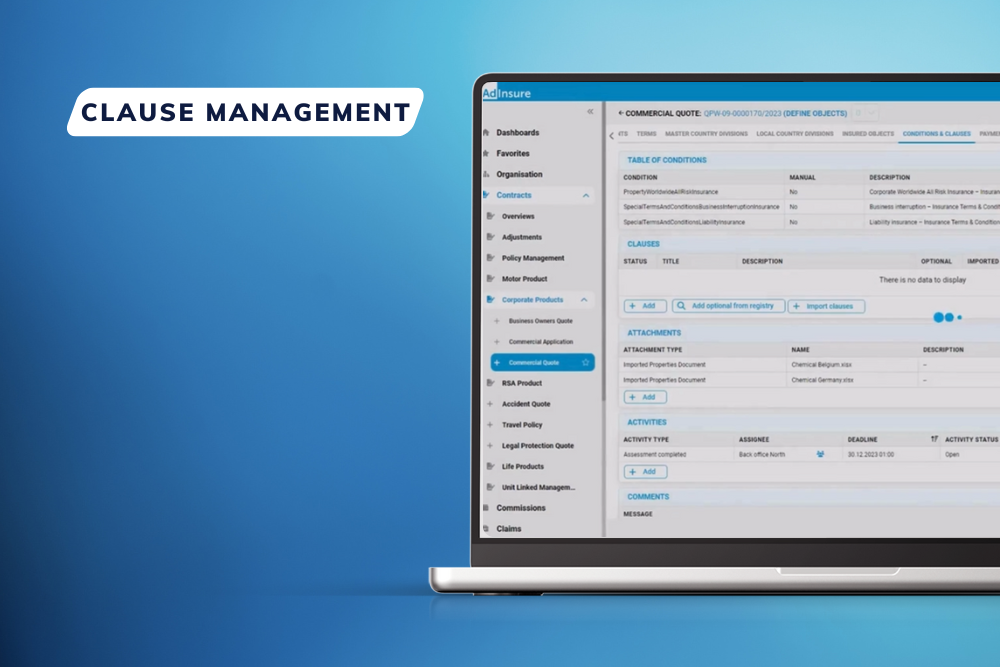

Clause management in commercial insurance agreements is critical because it precisely defines coverage terms, reduces legal and financial risks, ensures compliance, and prevents costly claims disputes.

As coverage options are selected during the quotation process, relevant clauses are automatically pulled from the Clause Library—instantly and accurately.

Clause relevance is powered by machine learning, suggesting specialized options—like fire insurance for the chemical industry—that can be added and customized.

Additional Clauses can also be added manually. Either from the Clause library with prefilled fields and matching suggestions, or imported from structured files that support multiple languages.

Finalized clauses are reviewed by underwriting and legal teams, who can refine the wording or propose new candidates for the Clause Library.

Once the clauses are confirmed, premiums can be adjusted by percentage or amount— e.g., a liability clause increasing the premium by 10%.

With everything in place, the offer is ready to be sent to the client.

Handle every stage of clause management—from defining terms to final approval and pricing—with AdIhnsure.