Sep 01, 2021

Adacta announces the 2021Q3 AdInsure release

Adacta, a leading provider of software solutions for the insurance industry, announced the 2021Q3 release of its AdInsure insurance platform. AdInsure, the platform insurers turn to accelerate innovation and grow their digital capabilities, now includes additional functionality further supporting insurers on their mission to become more agile, independent, and customer-focused.

New features bring additional business functionality to sales and policy management, commissions, reinsurance, claims, recoveries, billing, and collection. Updates to the framework and business infrastructure include user notifications, multilanguage printouts, improved activity search, enhanced web client, and much more.

Highlighted feature of AdInsure for Non-life insurance: Product wizards

The latest release focuses on Product wizards, an important feature of AdInsure Studio. The new wizards support the product teams as they work to streamline and improve the efficiency and quality of the product development process even further.

Product tariff wizard

The Product wizard guides the user through the product development process to create a new insurance product's basic technical structure (tariff) and business rules.

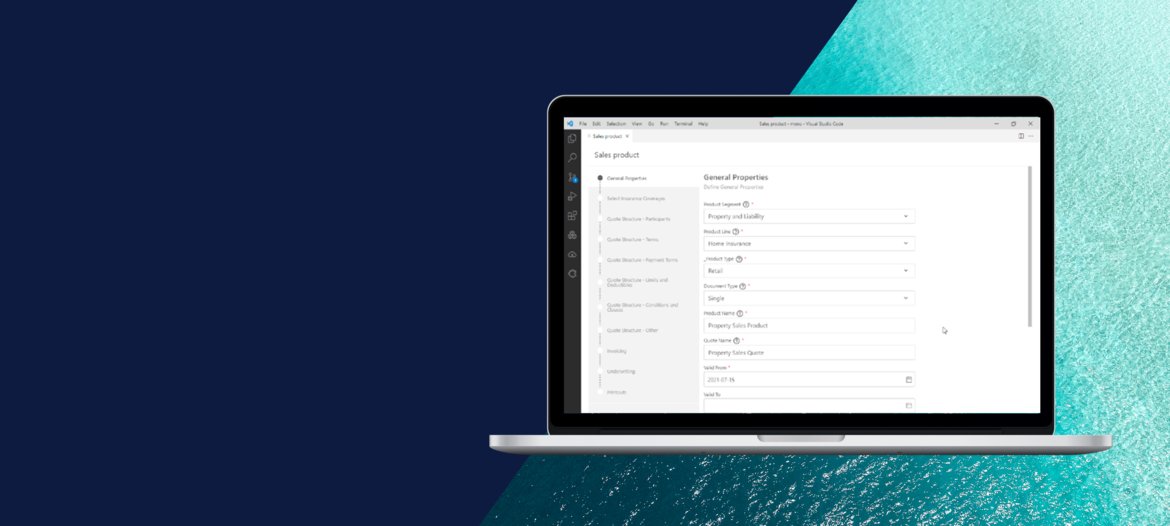

Sales product wizard

Product teams can use Sales product wizards to design, publish, and test new products quickly. Users can use the wizards to create the basic structure of a non-life sales product and generate rules.

Standardized product components

The latest release provides insurers with additional reusable product components, such as underwriters' dashboards, terms and conditions, activities, and much more.

Highlighted feature of the AdInsure for Life insurance: Investment-linked policy management

Investment insurance products are the focus of the 2021Q3 release of AdInsure for Life insurance. Additional functionality provides more options for customers and insurance teams and ensures higher levels of automation.

Bonus payments

Bonus payments can now simply be set up to reward policyholders’ loyalty. Payments in cash or units can be activated automatically for selected policies in the portfolio.

Unallocated costs

When a premium isn't paid on time or policy funds are insufficient, the system now deducts and stores the costs and automatically allocates them after a premium payment.

Investment strategy changes

The improvements include the option to change the investment strategy and transfer existing policy funds accordingly.

Policy loan document

The latest update includes a policy loan document and a contract outlining the loan terms, allowing policyholders to borrow a part of invested assets.

Cash reserves

Easily imported cash funds used to store cash reserves on the investment policy account come with a clear overview of cash reserves.

Transactions Rollback and Rollforward

In case of a price or event conflict, policy administrators can use the transactions rollback to revert transactions, or use roll-forward to create transactions on a subsection of the unit-linked portfolio.

Reports

Unit-Linked Management now includes account movements, account balance, sub-account balance, and fund order reports.

About Adacta

Adacta is a leading software provider for the insurance industry. Its insurance platform – AdInsure – provides Life and P&C insurers with a future-proof way to streamline their operations and processes. Since 1989, Adacta has spent decades helping insurance organizations grow their digital capabilities and drive increased profit. Their mission is simple: Empower tomorrow's industry leaders to realise their potential through technology.

About AdInsure

The AdInsure insurance platform is the digital foundation your business needs to keep up with industry changes. It connects and supports all your teams, helping you work smarter, launch products faster, and provide modern customer experiences.